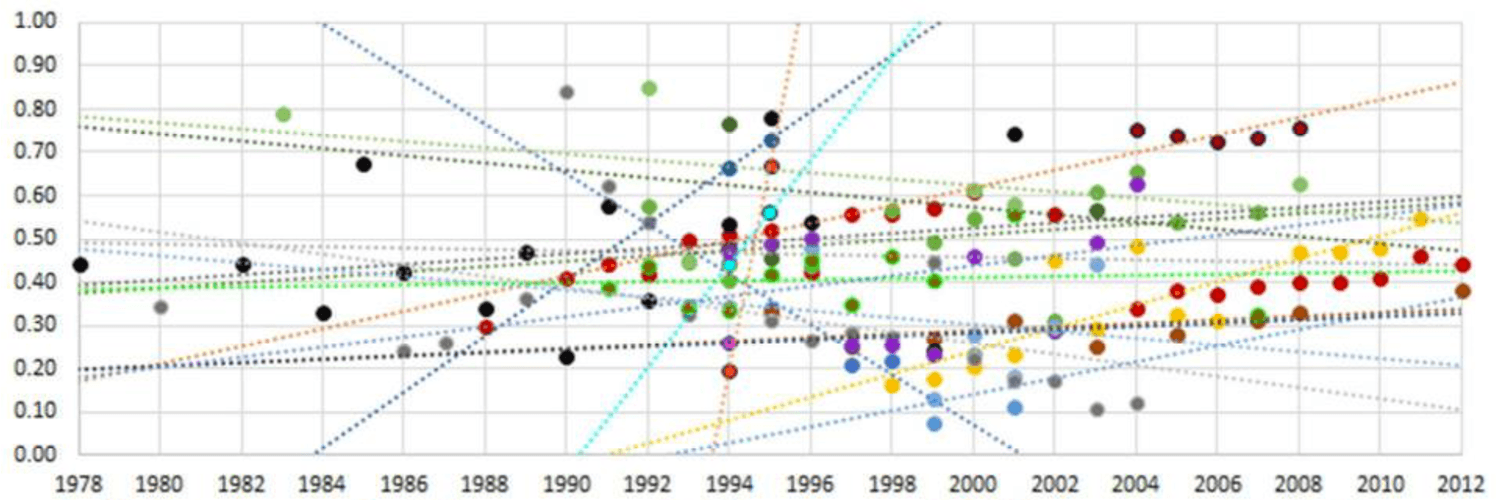

The purpose of this paper is to examine two prominent perspectives on business group functioning, institutional void (IV) and entrenchment/exploitation (EE), that make different predictions about the effect of business group (BG) on the economy. The authors examine the effects of BG prevalence in an economy and its effect on macroeconomic outcomes including foreign direct inward and outward investment, innovation and development of the financial sector. The authors build a unique database by extracting estimates of BG prevalence for multiple countries between 1978 and 2012 from the existing literature and use this to test conflicting predictions derived from the IV and EE perspectives, respectively. The authors find no consistent evidence that BG prevalence diminishes over time with economic development as IVs diminish, which is predicted by the IV perspective. Instead, the long-term persistence of BGs in many countries appears to be more consistent with the EE perspective. However, this study also finds no support for the perspective that high levels of BG prevalence are negatively associated with country-level indicators and determinants of economic development and competitiveness, as suggested by that perspective. The authors conclude that there is no robust support for either the IV or the EE perspective and highlight the need for more contextualized theorizing about the evolution of BGs.

Reference:

Michael Carney, Marc Van Essen, Saul Estrin, Daniel Shapiro. 2017. Business group prevalence and impact across countries and over time: What can we learn from the literature?, Multinational Business Review, 25(1): 52-76: https://doi.org/10.1108/MBR-10-2016-0037